2025 Year-In-Review: The Era of the Connected Therapeutic

Why Direct-to-Patient, Affordability Pressure, and Federal Programs Are Forcing a New Patient Experience Standard

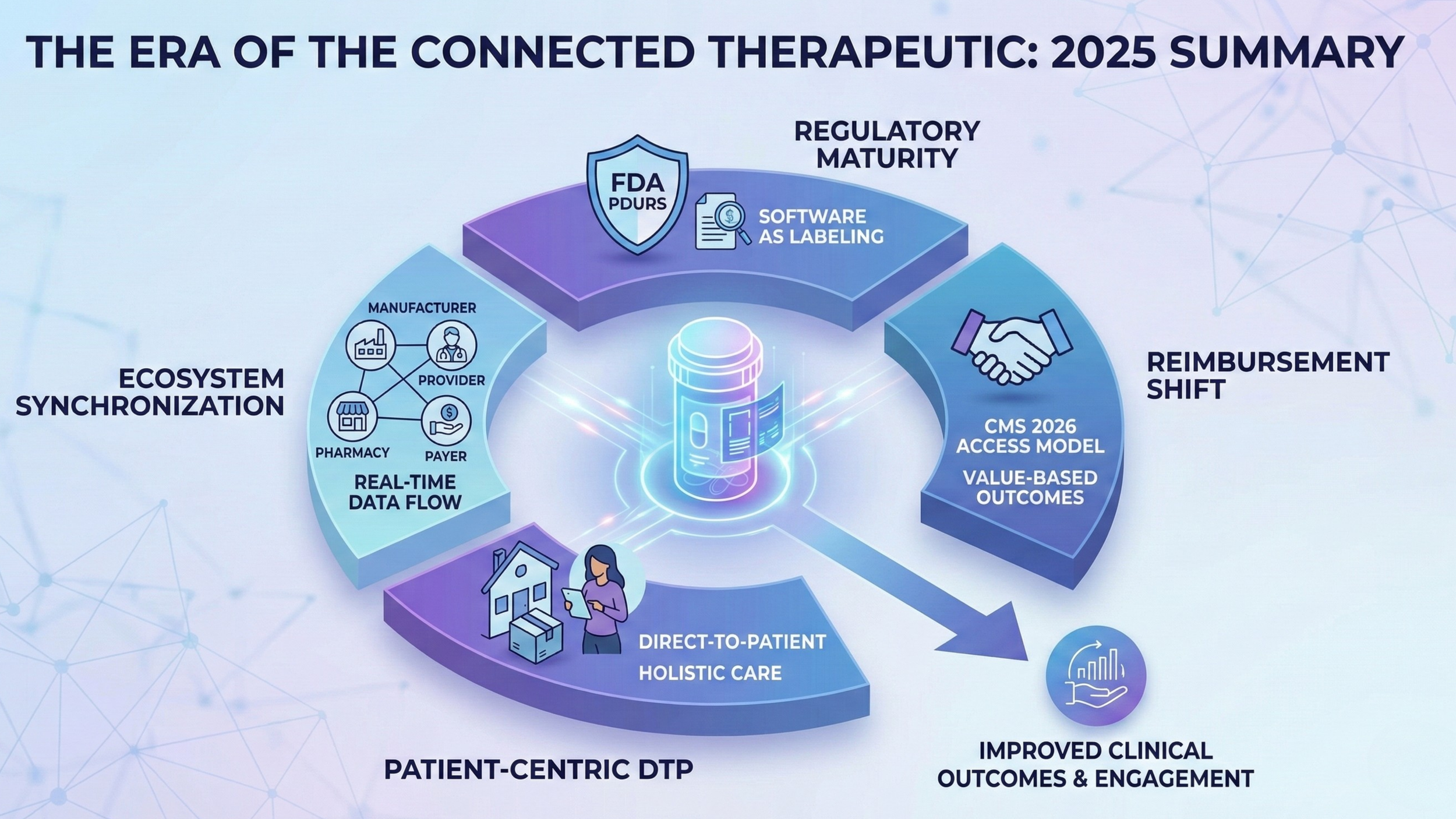

In 2025, the industry stopped debating whether the “digital layer” matters. It became obvious that it does, because the therapeutic journey is now being reshaped by three forces that are moving faster than most commercial teams expected: direct-to-patient models (DTP), affordability and pricing pressure, and federal programs that are explicitly rewarding proactive chronic care.

The headline is not that DTP grew. The headline is what DTP changed. It shifted accountability. As brands step closer to the patient, the definition of “therapy success” expands beyond the prescription and the first fill. The winners are the ones who can deliver an experience patients trust, partners can execute, and regulators and payers can recognize as credible evidence of value.

This is what the era of the connected therapeutic really means: not another app, not another portal, and not another dashboard. It is a new expectation that medication access, medication use, and the patient’s lived experience must work together as one system.

The Era of Connected Therapeutic: 2026 Outlook

DTP in 2025: Not a Channel, a Supply Chain Rewrite

DTP is often described as a new front door. That is true, but incomplete. DTP is a restructuring of the supply chain and the support model, with the patient’s home becoming the operating environment.

Platforms such as LillyDirect and PfizerForAll made the direction visible: a manufacturer-led experience that pulls together navigation, affordability pathways, prescribing access, and fulfillment into a single journey. That architecture is not just about convenience. It is a response to leakage.

Patients fall out at initiation, abandon during titration, pause when side effects hit, and disappear when costs spike. When those drop-offs happen, everyone loses: outcomes decline, therapy value becomes harder to prove, and commercial efficiency collapses.

The most important learning from 2025 is this: getting the patient the medication is no longer the finish line. It is the start of the relationship. DTP changes the balance between stakeholders because it forces the brand to care about what happens after the shipment, not just before it. That is where trust becomes the true differentiator.

Affordability Became a Design Constraint

Affordability in 2025 was not a background policy issue. It shaped strategy, product design, and partner selection.

The BALANCE model is a clear signal of where policy expectations are heading, especially around GLP-1s. The model explicitly ties expanded access to select GLP-1 therapies with evidence-based lifestyle support, with coverage launching in Medicaid as early as May 2026 and Medicare Part D in January 2027, plus a short-term Medicare demonstration expected to begin in July 2026 as a bridge.

At the same time, TrumpRx introduced a new kind of pressure: consumer-facing pricing pathways framed around “cutting out middlemen” and making discounted pricing easier to access. Whatever your view of the politics, the market implication is consistent: margin compression and transparency expectations are rising, and programs that cannot demonstrate sustained real-world use will be questioned.

The Critical Reframing for Brand Leaders: Affordability can win the start, but it does not win the journey. If a patient gets a discounted therapy and discontinues quickly because of side effects, confusion, stigma, or lack of timely support, the affordability investment becomes waste. That reality is pushing manufacturers to build systems that protect persistence, not just access.

Federal Signals in 2025: Outcomes and Proactive Care Are the Point

While affordability and DTP were changing the commercial environment, federal programs were changing the incentive structure.

CMS’s ACCESS Model: Designed to test an outcome-aligned payment approach in Original Medicare for technology-supported care, with the first cohort launching July 5, 2026. This is not subtle. It is an explicit bet that chronic disease management will be improved by technology-enabled, integrated care models that can prevent deterioration, not just respond to it.

FDA’s TEMPO Pilot: Connected to ACCESS, this pilot reinforces that alignment. The Federal Register notice states that FDA will begin collecting statements of interest starting January 2, 2026. The direction is clear: regulators and payers are exploring pathways that make it easier to evaluate and scale digital health technologies that can show meaningful outcomes in real-life settings.

CMS’s LEAD Model: This adds another layer. It is a 10-year voluntary ACO model running from January 1, 2027 through December 31, 2036, with applications expected to open in March 2026. The LEAD signal matters because it points to longer accountability arcs. Longer arcs increase the value of tools that can keep patients stable between visits, detect early risk, and drive adherence and follow-through.

In parallel, CMS’s Rural Health Transformation initiative publicly emphasized technology-enabled solutions, including remote monitoring and advanced technologies, as part of rural modernization. That matters because rural settings often face the sharpest staffing constraints. Low-friction patient engagement and exception-based triage are not optional there.

The Quiet Regulatory Shift: Software as Therapeutic Context

A second undercurrent strengthened in 2025: the regulatory posture around sponsor-influenced software that relates to drug use. FDA’s Prescription Drug Use Related Software (PDURS) draft guidance describes how certain prescription drug use-related software functions may be treated under labeling authorities.

The strategic implication for life sciences teams is not that “everything is regulated.” The implication is that the industry is moving toward a world where digital companions are judged less as marketing features and more as part of the therapeutic context.

As that line sharpens, evidence quality matters more. If a brand wants to claim that its companion improves persistence, reduces discontinuation, or strengthens outcomes, it will increasingly need credible measurement and real-world evidence that can withstand scrutiny. That pushes the market toward higher-resolution truth, closer to the dose moment, with the ability to capture why behavior happens, not just whether a refill happened later.

What Changed for Brand Leads and Digital Health Innovators

By the end of 2025, the playbook started to flip.

The old model was built on retrospective visibility: claims, refills, call center notes, and periodic surveys. The connected therapeutic model is built on real-time signals and immediate actions. The difference is not the data itself. The difference is the timing and the ability to respond while the patient is still in the moment that determines success.

That is why trust is now the core currency.

Patients do not stay on therapy because they got a portal link. They stay on therapy when the experience feels safe, easy, respectful, and helpful on the hard days. The hard days are predictable: week one, dose changes, side effect onset, a denied claim, a surprise copay, a missed dose after travel, a caregiver transition. If your system cannot detect those moments and deliver the next best action, it does not matter how good your onboarding looked.

For digital health innovators, 2025 also clarified what will not work: solutions that add friction, add logins, and add noise to clinical workflows. Adoption is becoming more practical and less aspirational. If the experience does not fit into the supply chain and the patient’s daily life, it will not scale.

2026 and Beyond: How the Ecosystem Shifts

For Pharma and Brand Teams: DTP will continue to expand, but the differentiator will shift from access mechanics to longitudinal performance. Brands will increasingly compete on experience integrity: sustained persistence, patient trust, and measurable outcomes that can be defended in payer and policy conversations.

For Pharmacies: DTP creates pressure on distribution dynamics, but it also elevates the value of being a clinically effective partner that can intervene early. In an outcomes-driven world, the pharmacy’s ability to identify risk, triage, and keep patients stable becomes more valuable, not less.

For Providers and Health Systems: Models like ACCESS make proactive chronic care financially more relevant, but only if workflows are built for exception-based action. Clinicians do not need more dashboards. They need fewer false alarms and faster identification of patients who are truly at risk. [Source: Centers for Medicare & Medicaid Services]

For Payers and PBMs: Affordability pressure and transparency expectations keep increasing. That will raise demand for verified real-world utilization and credible evidence that therapy investments are translating into avoided deterioration and avoidable utilization.

For Patients: Expectations will keep moving toward consumer-grade simplicity with clinical-grade trust. Patients will compare therapy experiences the way they compare services: clarity, privacy, credibility, and support that shows up at the right time.

Turning the Package Into a Trust-Building Front Door

In this new landscape, the medication package is no longer a passive container. It is the lowest-friction, most universal touchpoint in the entire journey. That matters because behavior happens at the package, not in the claims file.

Synchronyx’ Tappt technology is built around that premise: dose-level companion intelligence that captures real-world use as it happens, pairs it with context, and turns it into timely support actions across the therapy ecosystem.

In practice, that means helping life sciences teams move from retrospective proxies to a more defensible view of persistence and patient experience; helping pharmacies and care teams identify when a patient is struggling early; and helping programs demonstrate real value beyond access alone.

The connected therapeutic era is not about adding “more digital.” It is about building a therapeutic experience that is measurable, trusted, and operationally real.

Closing Thought: 2025 Was the Inflection Point

The lesson of 2025 is simple: access is necessary, but insufficient. DTP, affordability initiatives, and federal outcome-aligned programs are all pushing the ecosystem toward one destination: care models that prevent failure rather than react to it.

In 2026, the brands and innovators that lead will be the ones that design for the full journey, treat trust as a clinical asset, and build systems that can prove what happened at the moments that matter.